Remember when getting your finances in order meant drowning in spreadsheets, fighting with budgeting apps you'd abandon by February, and feeling guilty every time you checked your bank balance?

Here's the good news: in 2026, how AI can help you get in better financial shape has completely changed the game. Think of AI as your digital personal trainer for money—except this one never judges you for that late-night online shopping spree and works 24/7 to keep you on track.

You don't need a finance degree or a love of budgeting to take control of your money anymore. AI tools now do the heavy lifting: they spot the subscriptions you forgot about, find extra money hiding in your daily transactions, and even predict what you'll need before you realize it yourself. The best part? These tools are designed for real people with messy financial lives, not just spreadsheet enthusiasts.

This guide breaks down seven AI-powered money moves that can transform your financial health without the overwhelm. Keep it simple, start with one goal, and let's build momentum together.

Key Takeaways

- AI automates the boring stuff: From tracking every transaction to calculating your net worth in real-time, AI handles the financial busywork you've been avoiding

- Start with quick wins: AI can find forgotten subscriptions and hidden fees within minutes, putting money back in your pocket this week

- No budgeting required: AI gives you dynamic “available to spend” balances that adjust automatically—no more rigid budgets you'll abandon

- Debt freedom made simple: AI runs simulations to show your fastest path out of debt and can even automate extra payments from spare change

- 24/7 financial support: Unlike human advisors, AI tools answer questions instantly and provide personalized guidance whenever you need it

Move #1: Get Your Automated Financial Checkup (Do This First)

The first step to better financial shape is knowing exactly where you stand right now. But let's be honest—manually listing every bank account, credit card, student loan, and investment account sounds about as fun as watching paint dry.

Here's where AI changes everything.

AI-driven financial apps can automatically connect to all your accounts and give you a complete picture in minutes, not hours. These tools aggregate your savings accounts, checking accounts, mortgages, car loans, credit cards, and investment portfolios into one dashboard. No spreadsheets. No calculator. No headaches.

How AI Creates Your Real-Time Financial Snapshot

Modern AI financial tools use secure connections to pull data from your financial institutions. Once connected, the AI automatically:

- Calculates your net worth by adding up all assets and subtracting all debts

- Categorizes every transaction so you can see exactly where your money goes

- Tracks your cash flow to show if you're spending more than you earn

- Updates everything in real-time as transactions happen

AI now creates customized financial plans based on your actual transaction behavior and past patterns, rather than suggesting generic one-size-fits-all advice[1]. This means the insights you get are tailored to your real life, not some theoretical budget.

Real-World Example: Sarah's Quick Win

Sarah, a freelance graphic designer, had accounts scattered across four banks, two credit cards, and a 401(k) from her old job. She avoided looking at the big picture because gathering all that information felt overwhelming.

She connected an AI financial app (like Mint or Personal Capital) during her lunch break. Within 15 minutes, she discovered:

- Her actual net worth was $8,200 higher than she thought (she'd forgotten about an old savings account)

- She was spending $347/month on subscriptions and recurring charges

- Her cash flow was positive by $520/month—she just needed to redirect it

Copy and paste this approach: Pick one AI financial aggregator app, connect your accounts, and spend 20 minutes reviewing the automated insights. That's your first quick win.

For those looking to build a stronger foundation, developing a positive money mindset works hand-in-hand with these practical AI tools.

Move #2: How AI Can Help You Get In Better Financial Shape With Intelligent Goal Setting

Generic financial advice tells you to “save more” or “spend less.” Thanks for nothing, right? AI takes a completely different approach by analyzing your actual habits and suggesting specific, achievable steps that fit your lifestyle.

Setting Micro-Goals That Actually Work

Instead of vague goals like “save $10,000,” AI can break that down into bite-sized pieces:

- Increase your 401(k) contribution by 1% (AI calculates the exact impact on your take-home pay)

- Limit dining out to $200 this month (AI sends real-time alerts when you're at $150)

- Save $50 per paycheck automatically (AI moves it before you can spend it)

AI analyzes transaction behavior and life events to identify potential financial needs before you realize them yourself[1]. For example, if you've been searching for homes online and your rent lease is ending soon, AI might proactively suggest starting a down payment fund.

Step-by-Step Goal Creation with AI

Here is the plan for setting up intelligent goals:

- Tell the AI what matters to you (emergency fund, vacation, debt payoff, retirement)

- Let AI analyze your spending patterns to find realistic contribution amounts

- Review AI's suggested timeline based on your current cash flow

- Set up automated transfers so it happens without willpower

- Get progress notifications that keep you motivated

Use this prompt in any AI financial tool:

“Based on my spending over the last 3 months, how much can I realistically save each month toward [your goal] without feeling squeezed? Show me the timeline to reach [dollar amount].”

The Power of Small Percentage Changes

One of AI's superpowers is showing you the long-term impact of tiny changes. A 1% increase in your retirement contribution might only reduce your paycheck by $40, but over 30 years with compound growth, that could mean an extra $75,000 in retirement.

AI makes these calculations instant and visual, so you can see the tradeoff clearly and make informed decisions. Test and adjust until you find the sweet spot between current comfort and future security.

Move #3: Precision Spending Control (Without the Budget Spreadsheet)

If you've tried traditional budgeting and failed, you're not alone. Static budgets don't account for real life—the car repair that pops up, the friend's wedding gift, the grocery prices that keep climbing.

AI-powered spending control is different. It's dynamic, flexible, and actually helpful.

How AI Finds Your Hidden Money Leaks

AI excels at spotting the “hidden” expenses that drain your accounts without you noticing:

- Forgotten subscriptions: That streaming service you signed up for during the free trial and never canceled ($14.99/month = $180/year)

- Duplicate charges: The gym membership you're paying for at two locations

- Price increases: Services that quietly raised rates from $9.99 to $14.99

- Unused services: The premium software plan when you only use basic features

One AI tool found that the average person has 3-4 forgotten subscriptions totaling $200-300 per year. That's money you can redirect toward goals that actually matter to you.

Dynamic “Available to Spend” Balances

Instead of rigid budget categories, modern AI tools calculate your “available to spend” balance throughout the month. Here's how it works:

The AI knows:

- Your total income for the month

- Your fixed bills (rent, utilities, insurance, loan payments)

- Your savings goals (already set aside automatically)

- Your variable spending so far this month

It calculates:

Available to Spend = Income – Fixed Bills – Savings Goals – Spent So Far

This number updates in real-time as you make purchases. No math required. No guilt about “blowing the budget.” Just a simple answer to “Can I afford this right now?”

Simple Workflow for Spending Control

Do this first:

- Connect your primary spending accounts to an AI financial app

- Review the AI's spending category breakdown from last month

- Identify your top 3 variable spending categories (usually dining, shopping, entertainment)

- Set soft limits for each category (AI will alert you, not block you)

- Check your “available to spend” balance before major purchases

Quick win: Let AI analyze your last 90 days of transactions and present a list of recurring charges. Cancel just one forgotten subscription this week and you've already made progress.

If you're looking for additional ways to boost your income while managing expenses, explore these strategies for making money online that can complement your financial improvement plan.

Move #4: AI-Optimized Debt Reduction Strategies

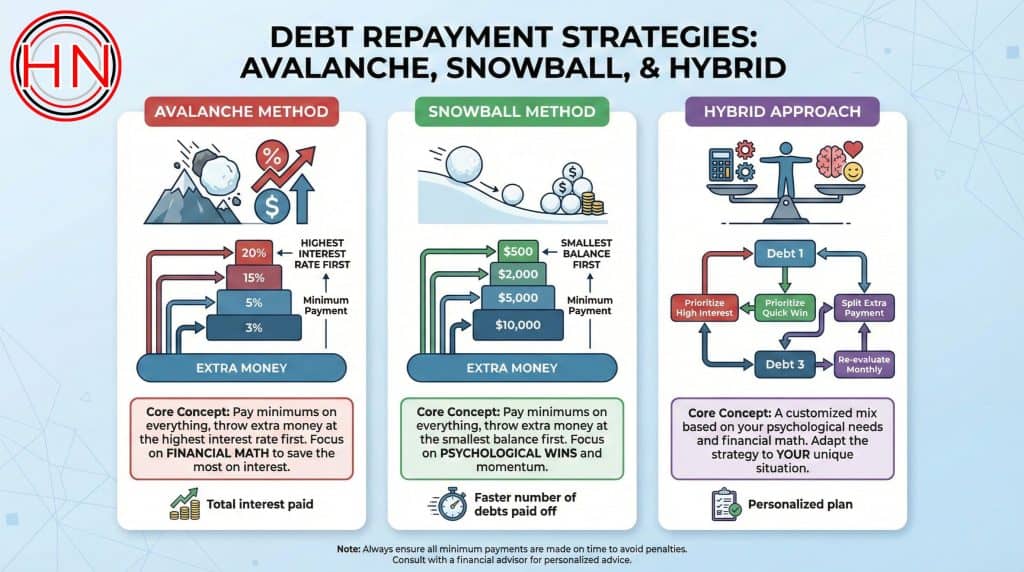

Debt feels overwhelming because there are so many variables: interest rates, minimum payments, balances, and competing advice about which debt to tackle first. Should you pay off the smallest balance for a psychological win (snowball method) or the highest interest rate to save money (avalanche method)?

Stop guessing. Let AI run the numbers.

How AI Simulates Your Debt-Free Date

AI-powered debt tools can analyze all your debts simultaneously and run multiple scenarios in seconds:

- Avalanche method: Pay minimums on everything, throw extra money at the highest interest rate first

- Snowball method: Pay minimums on everything, throw extra money at the smallest balance first

- Hybrid approach: A customized mix based on your psychological needs and financial math

The AI shows you the exact payoff date and total interest paid for each strategy. No more wondering “what if”—you'll see the concrete numbers.

Real-World Example: Marcus's Debt Journey

Marcus had:

- Credit Card A: $4,200 at 22% APR

- Credit Card B: $1,800 at 18% APR

- Student Loan: $12,000 at 5% APR

- Car Loan: $8,500 at 4% APR

He had an extra $300/month to put toward debt but didn't know where to start.

An AI debt calculator ran the scenarios:

Avalanche method (highest interest first):

- Debt-free in 34 months

- Total interest paid: $3,240

Snowball method (smallest balance first):

- Debt-free in 36 months

- Total interest paid: $3,580

The avalanche method would save Marcus $340 and get him debt-free 2 months sooner. He chose that path and set up automated extra payments to Credit Card A.

Automated Debt Payments from Spare Change

Some AI tools take automation even further. They analyze your daily transactions and “round up” purchases to the nearest dollar, automatically applying that spare change to your highest-interest debt.

For example:

- Coffee: $4.75 → rounds to $5.00 (25¢ to debt)

- Groceries: $67.32 → rounds to $68.00 (68¢ to debt)

- Gas: $41.15 → rounds to $42.00 (85¢ to debt)

These tiny amounts add up. The average person can pay an extra $50-100/month toward debt without feeling the pinch of a single large transfer.

Step-by-Step Debt Reduction Plan

Here is the plan:

- List all debts with balances, interest rates, and minimum payments (or let AI pull this automatically)

- Use an AI debt calculator to run avalanche vs. snowball scenarios

- Choose your strategy based on the numbers and your personality

- Set up automated extra payments to your target debt

- Enable round-up features if available to accelerate progress

- Review progress monthly and celebrate milestones

Use this prompt in ChatGPT or a financial AI tool:

“I have the following debts: [list them with balances and interest rates]. I can put an extra $[amount] toward debt each month. Show me the avalanche method payoff timeline and the snowball method payoff timeline. Which saves me more money?”

Move #5: How AI Can Help You Get In Better Financial Shape by Paying Yourself First (Automatically)

The classic financial advice “pay yourself first” means putting money into savings before you spend on anything else. The problem? It requires discipline, and discipline runs out when life gets busy.

AI removes the discipline requirement entirely.

Automated Savings That Happens in the Background

Modern AI savings tools use multiple strategies to build your emergency fund and investment accounts without you thinking about it:

Round-up savings: AI rounds your purchases to the nearest dollar and transfers the difference to savings (just like the debt strategy, but for your future instead)

Percentage-based transfers: AI automatically moves a percentage of every paycheck to savings before you see it

Smart timing: AI learns your cash flow patterns and moves money on days when your balance is highest, avoiding overdraft risks

Goal-based buckets: AI divides your savings into specific goals (emergency fund, vacation, down payment) so you can see progress toward each

Real-World Example: The $1,000 Emergency Fund

Financial experts recommend having at least $1,000 for emergencies before aggressively paying down debt. For many people, saving that first $1,000 feels impossible.

Here's how AI makes it simple:

Month 1: Enable round-up savings on all purchases

- Average round-ups: $45

Month 2: Add automatic transfer of $50 per paycheck (twice per month)

- Round-ups: $45

- Automatic transfers: $100

- Total: $145

Month 3: AI analyzes your spending and finds you can safely transfer an extra $30 on the 15th of each month

- Round-ups: $45

- Automatic transfers: $100

- Smart transfer: $30

- Total: $175

Result: $1,000 emergency fund in 6-7 months without a single manual transfer or moment of willpower.

Pumping Up Your Savings Without Pain

The beauty of automated AI savings is that you never feel the pinch of a single large transfer. Instead of trying to move $500 at once (which hurts and often gets skipped), AI moves $5 here, $12 there, $8 here—amounts so small you don't notice them missing.

But they add up fast.

According to recent data, 61% of CFOs agree that AI has made financial processes easier, with companies seeing an average 35% return on AI investments in 2025[2]. While that data focuses on businesses, the same principle applies to personal finance—AI creates efficiency that translates to real results.

Simple Workflow for Automated Savings

Start with one goal:

- Choose your first savings goal (emergency fund, vacation, down payment)

- Set the target amount and desired timeline

- Enable round-up savings in your AI financial app

- Add one automatic transfer (even if it's just $25 per paycheck)

- Let AI suggest optimizations after analyzing your spending for 30 days

- Build momentum by watching the balance grow without effort

Quick win: Set up round-up savings today. You'll have $40-50 saved by the end of the month without changing your spending habits.

For those interested in building additional income streams to boost savings even faster, consider exploring passive income strategies that work while you sleep.

Move #6: Curated Investment Literacy (Your AI Financial Tutor)

Investing feels intimidating when you're bombarded with jargon: ETFs, dividend yields, expense ratios, asset allocation, rebalancing. Most people avoid investing altogether because they don't want to make expensive mistakes.

AI acts as your personalized tutor, explaining concepts in simple terms and curating learning resources based on your actual portfolio and interests.

How AI Teaches You to Invest

Traditional financial education is generic—books and courses that cover everything whether you need it or not. AI takes a different approach:

Contextual learning: AI explains concepts when they're relevant to your situation. When you're looking at a dividend ETF, AI explains what dividends are and how they work.

Plain language: AI translates financial jargon into simple words. Instead of “expense ratio,” it might say “the annual fee you pay to own this fund, expressed as a percentage.”

Personalized curriculum: Based on your portfolio and goals, AI suggests specific articles, videos, and courses that match your learning style and knowledge gaps.

Question answering: You can ask AI anything about investing, anytime, and get immediate answers without feeling judged for “basic” questions.

Real-World Example: Learning by Doing

Jennifer wanted to start investing but felt overwhelmed by all the options. She opened a robo-advisor account (which uses AI to manage investments) with $500.

The AI asked simple questions:

- What are you saving for? (Retirement)

- When do you need this money? (In 30 years)

- How would you feel if your investment dropped 20% in a year? (Nervous but I'd stay invested)

Based on her answers, the AI created a diversified portfolio of low-cost index funds: 80% stocks, 20% bonds.

But here's where the learning happened: Every time Jennifer logged in, the AI explained what was happening in her portfolio in simple terms:

- “Your stocks are up 2% this month because technology companies reported strong earnings.”

- “We rebalanced your portfolio by selling some stocks and buying bonds to maintain your target mix.”

- “You received $3.47 in dividends this quarter. We automatically reinvested it to buy more shares.”

Over six months, Jennifer learned more about investing from these contextual explanations than she had from years of avoiding the topic.

AI-Curated Learning Resources

AI can analyze your investment knowledge level and interests, then recommend specific resources:

Beginner: “You're new to investing. Start with this 10-minute video explaining index funds.”

Intermediate: “You understand the basics. Here's an article comparing dividend growth strategies for your portfolio type.”

Advanced: “You're ready for tax-loss harvesting strategies. Here's a case study relevant to your situation.”

This curated approach saves time fast—you're not wading through irrelevant information trying to find what applies to you.

Step-by-Step Investment Learning with AI

Keep it simple:

- Start with a robo-advisor or AI-powered investment app (Betterment, Wealthfront, or similar)

- Begin with a small amount you're comfortable with ($50-500)

- Ask the AI to explain every recommendation it makes

- Read the curated resources the AI suggests (start with just one per week)

- Track your learning by asking yourself: “Do I understand why my portfolio looks like this?”

- Gradually increase your investment amount as your confidence grows

Use this prompt in ChatGPT or your investment app's AI assistant:

“I'm a complete beginner to investing. I have $[amount] to invest for [goal] in [timeframe]. Explain in simple terms what type of investments would be appropriate and why.”

Move #7: Always-On AI Support (Your 24/7 Financial Coach)

Human financial advisors provide valuable objective perspective, but they're not available at 11 PM when you're stressing about a financial decision. They also typically require minimum investment amounts ($100,000+ for many advisors) that put them out of reach for people just starting their financial journey.

AI provides 24/7 support without minimums or judgment.

How AI Chatbots Answer Your Money Questions

Modern AI financial chatbots can:

- Answer specific questions about your financial plan instantly

- Explain complex concepts in terms you understand

- Provide scenario analysis (“What if I increase my 401(k) contribution to 8%?”)

- Offer encouragement when you're feeling discouraged about progress

- Connect you with human help when situations require professional expertise

Nearly all organizations (99%) that have adopted AI agree it has improved their operational efficiency and workforce productivity[2]. The same principle applies to personal financial management—AI makes the process more efficient and less overwhelming.

Finding Your Financial Accountability Buddy

AI-powered social investing platforms use algorithms to connect you with other investors in similar life stages, creating accountability and community:

- Match with financial buddies who have similar goals and challenges

- Share progress and setbacks in a supportive environment

- Learn from others' experiences without repeating their mistakes

- Stay motivated through community challenges and milestones

This social element makes financial improvement feel less lonely and more achievable. When you see someone else paying off debt or building their emergency fund, it reinforces that you can do it too.

Real-World Example: The Midnight Money Question

David was lying awake at 1 AM worrying about whether he should pause his debt payments to build a bigger emergency fund. His financial advisor wouldn't be available until business hours, and the anxiety was keeping him up.

He opened his AI financial app and asked: “I have $500 in my emergency fund and $8,000 in credit card debt. Should I focus on building my emergency fund to $1,000 before making extra debt payments?”

The AI responded within seconds:

“Yes, financial experts generally recommend having at least $1,000 in emergency savings before aggressively paying down debt. Here's why: Without an emergency fund, unexpected expenses (car repair, medical bill) would force you to add more debt. Based on your current savings rate, you'll reach $1,000 in 3 months. Then you can redirect that money to your credit card debt. This approach gives you a safety net while still making progress.”

David felt immediate relief. He had a clear plan and could finally sleep. The next morning, he adjusted his automated transfers to prioritize the emergency fund for three months.

When AI Connects You to Human Help

AI is powerful, but it's not a replacement for human expertise in complex situations:

- Tax planning for complicated situations

- Estate planning and legal documents

- Major life transitions (divorce, inheritance, business sale)

- Emotional support during financial crises

Good AI financial tools recognize their limitations and proactively suggest when you should consult a human professional. They can even help you prepare for that conversation by organizing your financial information and clarifying your questions.

Step-by-Step Guide to AI Financial Support

Here is the plan:

- Choose an AI financial app with chatbot support (many are free or low-cost)

- Ask a simple question to test the system (“How much should I have in my emergency fund?”)

- Use the AI for daily questions instead of googling random financial advice

- Join AI-powered communities or social investing platforms for accountability

- Set up notifications for progress updates and encouragement

- Escalate to human advisors when situations exceed AI capabilities

Beginner-friendly approach: Start by asking your AI financial tool one question per day. Build the habit of turning to AI for financial guidance instead of making decisions based on stress or guesswork.

For those looking to leverage AI in other areas of their business or side hustle, explore this comprehensive guide to AI-powered business tools that can transform your entrepreneurial efforts.

Making It All Work Together: Your Clear Next Step

You've just learned seven AI-powered money moves that can transform your financial health. But here's the truth: knowing about these strategies doesn't change anything. Taking action does.

Do this first: Pick ONE move from this list to implement this week. Just one.

Not sure which to choose? Here's a decision tree:

If you don't know where you stand financially → Start with Move #1 (Automated Financial Checkup)

If you know your numbers but lack direction → Start with Move #2 (Intelligent Goal Setting)

If you're bleeding money on forgotten subscriptions → Start with Move #3 (Precision Spending Control)

If debt is your biggest stress → Start with Move #4 (AI-Optimized Debt Reduction)

If you can't seem to save money → Start with Move #5 (Automated Savings)

If investing confuses you → Start with Move #6 (Curated Investment Literacy)

If you need ongoing support → Start with Move #7 (Always-On AI Support)

Build Momentum One Tool at a Time

The biggest mistake people make is trying to implement everything at once. They download five apps, set up ten automations, and feel overwhelmed within a week.

Keep it simple: Master one move before adding the next. Give yourself 2-4 weeks with each strategy before layering on another. This approach builds sustainable habits instead of creating another system you'll abandon.

Test and Adjust Your Approach

AI provides data and automation, but you're still in control. After implementing any of these moves:

- Review the results after 30 days

- Adjust the settings based on what's working and what's not

- Celebrate small wins (even saving $20 is progress)

- Be honest about effort (some strategies require more setup than others)

Remember: results depend on effort. AI makes the process easier and more efficient, but it's not magic. You still need to connect the accounts, review the insights, and make decisions based on the data.

Make It Repeatable

Once you've successfully implemented one or two moves, you've created a simple workflow you can repeat:

- Identify the financial challenge

- Find an AI tool designed for that specific problem

- Connect your accounts and let AI analyze the data

- Review AI's recommendations

- Implement the automation or strategy

- Check progress monthly

- Adjust as needed

This repeatable process means you can continue improving your financial shape over time, one AI-powered move at a time.

For those who want to address the mental side of money management, eliminating toxic money habits can amplify the effectiveness of these AI tools.

Conclusion: Your Financial Shape Starts Today

Getting in better financial shape doesn't require a finance degree, a love of budgeting, or superhuman discipline. In 2026, AI has democratized access to sophisticated financial tools that were once available only to the wealthy.

How AI can help you get in better financial shape comes down to three core benefits:

- Automation eliminates the boring, repetitive tasks that drain your motivation

- Intelligence provides personalized insights based on your actual behavior, not generic advice

- Support gives you 24/7 access to guidance without judgment or minimum account requirements

The seven moves covered in this guide—automated checkups, intelligent goals, precision spending control, optimized debt reduction, automated savings, curated investment learning, and always-on support—work together to create a comprehensive financial improvement system.

But you don't need all seven to start seeing results. You just need one.

Your clear next step: Choose one move from this article. Download one AI financial app. Connect one account. Take one action this week.

That single step creates momentum. And momentum is what transforms your financial situation from overwhelming to manageable, from stressful to empowering.

The AI tools are ready. The strategies are proven. The only question is: which move will you make first?

Get results this week by starting small, staying consistent, and letting AI handle the heavy lifting. Your better financial shape is waiting—and it's more achievable than you think.

Financial Disclaimer

This blog post is for general educational and informational purposes only. It is not financial, investment, tax, or legal advice. I am not a licensed financial advisor, and I do not know your personal situation. You are responsible for your decisions and results. Before you act on anything in this post, review your numbers and talk with a qualified professional.

References

[1] Ai Trends In Finance – https://indatalabs.com/blog/ai-trends-in-finance

[2] Ai Trends Financial Management 2026 – https://www.citizensbank.com/corporate-finance/insights/ai-trends-financial-management-2026.aspx

DISCLOSURE: THIS POST MAY CONTAIN AFFILIATE LINKS, MEANING I GET A COMMISSION IF YOU DECIDE TO MAKE A PURCHASE THROUGH MY LINKS (AT NO COST TO YOU)